Imagine retiring after a lifetime of public service — as a veteran, air traffic controller, or first responder — only to wait six months in financial limbo because a decades-old government process can't handle your application.

That was the reality for thousands of federal retirees every year since the 60's, having to apply for retirement within a paper-based, broken system plagued by delays and inefficiency.

If you had told us we’d relocate our lives to move to D.C. to fix this, we’d have called it ridiculous.

Yat had just left a decade-long run at Airbnb, helping to build it from scrappy startup to public company; likewise, Dennis also came from startups in manufacturing and AI. Government work simply wasn’t in the life plan.

Yet in under a year, our team of two has transformed this outdated paper process into a modern, digital workflow. The new system is on track to handle 100,000 digital applications by the end of the year, many of which will experience significantly reduced processing time.

We share our experience in this blog post in hopes that what started as a mission to give retirees the transition they deserve can turn into something bigger: a proven playbook for modernizing outdated government systems. The same systematic problems we encountered are not unique to retirement, and our approach to them can hopefully be applied to streamlining other outdated areas where citizens interface with their government — from applying for benefits, to filing taxes.

We're proud to have cut through some bureaucracy and make an impact here, and we’re excited for what's possible when talented builders turn their skills to public service.

What Makes Retirements So Complicated?

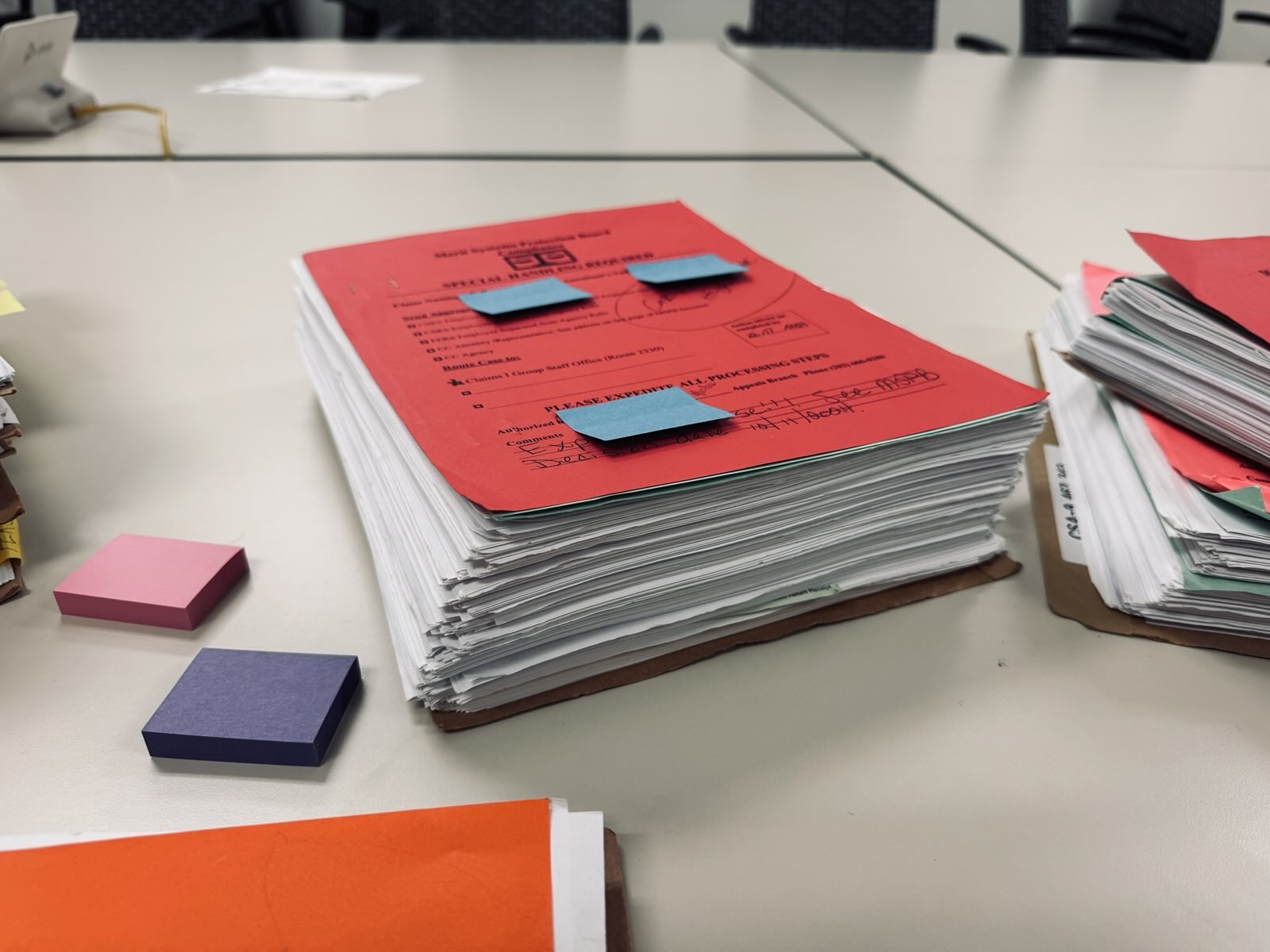

Before we arrived, when a federal employee retired, they began by preparing a thick stack of forms to submit to their HR department. Processing this case would involve multiple government parties further assembling and verifying information from additional records. Their HR office, their payroll providers, and OPM each needed to individually review every piece of paper for consistency and accuracy.

This process can take over six months. During this time, retirees receive only partial payments — sometimes enough to get by, but less than their full annuity.

It evolved this way over time: new retirement laws had to be supported, checks were added to reduce error rates on paper forms, and digital systems were added piecemeal but never integrated.

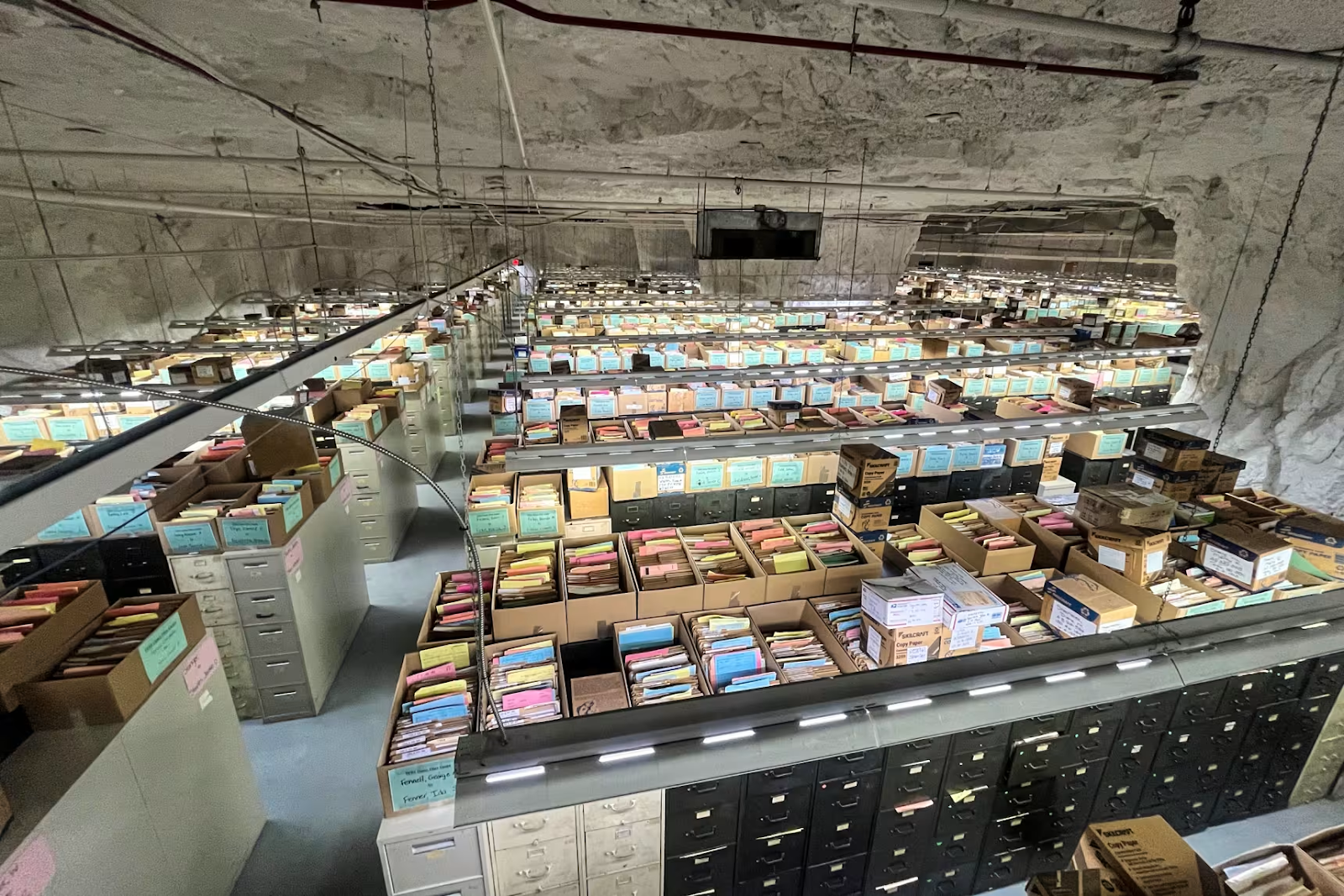

The result was significant inefficiency. For OPM, this even meant physically pulling historic records about retirees from an underground mine in Pennsylvania, where millions of paper records are stored in vast rows of file cabinets.

These challenges hadn't gone unnoticed. In fact, OPM had launched no fewer than three separate modernization initiatives in the 1980s, '90s, and '00s, pouring an estimated $130 million of taxpayer money to try to move this process off of paper. Every single initiative failed.

A 2014 Washington Post investigation captured the issues in vivid detail, but that article could just as easily have been written in early 2025. Despite over a decade passing, progress remained glacial, and nothing had seemingly changed.

This was the broken system we walked into earlier this year.

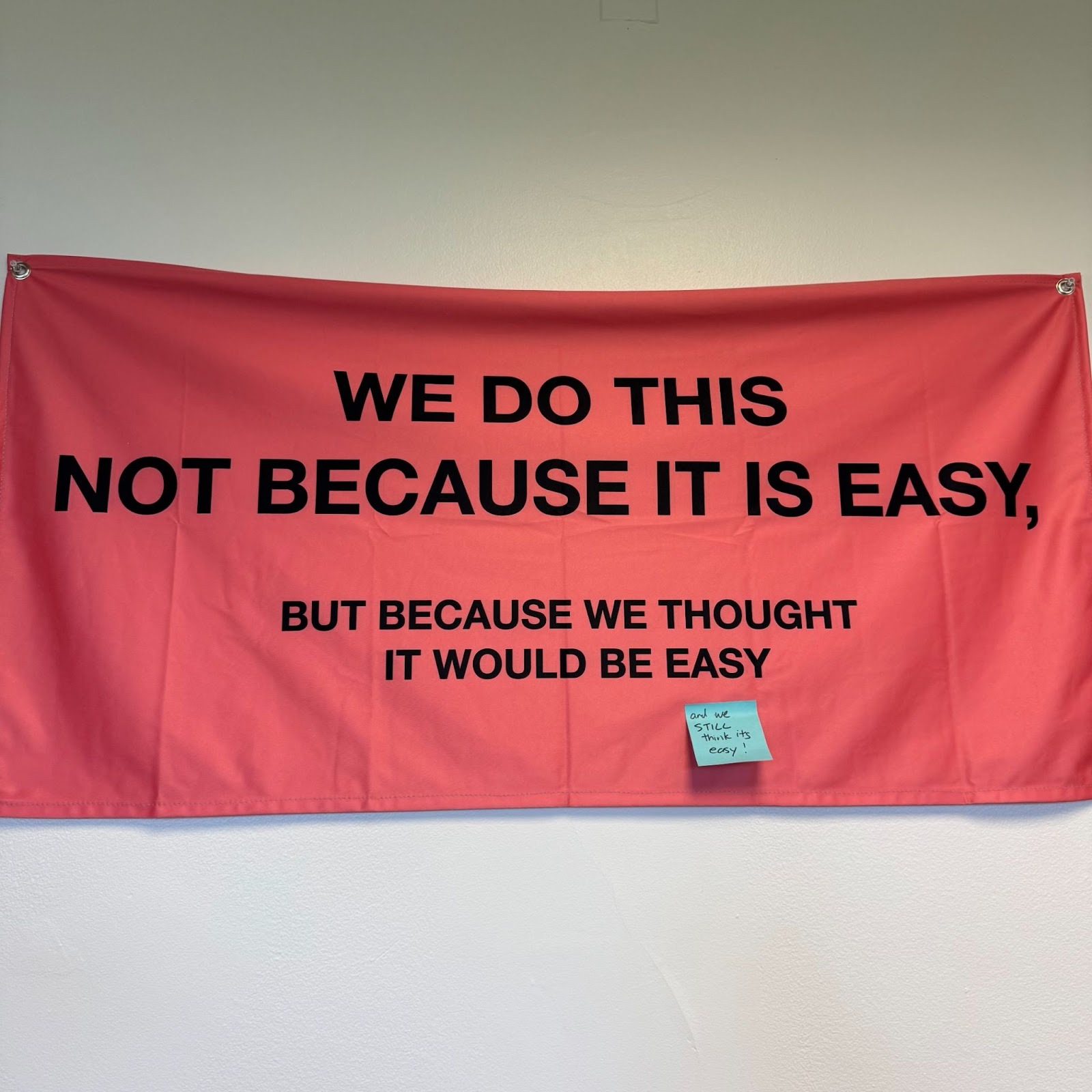

At the time, we knew only about the crippling inefficiencies of the paper system, not the string of failed efforts that had come before. So perhaps emboldened by sheer naiveté, we set out to do what our predecessors couldn’t: actually modernize federal retirement processing and deliver something that could finally last.

Digitization and retire.opm.gov

Our first priority was bringing the whole system online, immediately.

Speed was of the essence in order to stop the bleeding. We issued a public memo for a government-wide cutoff of new paper into The Mine. In order to support this, the digital replacement had to be ready within a month.

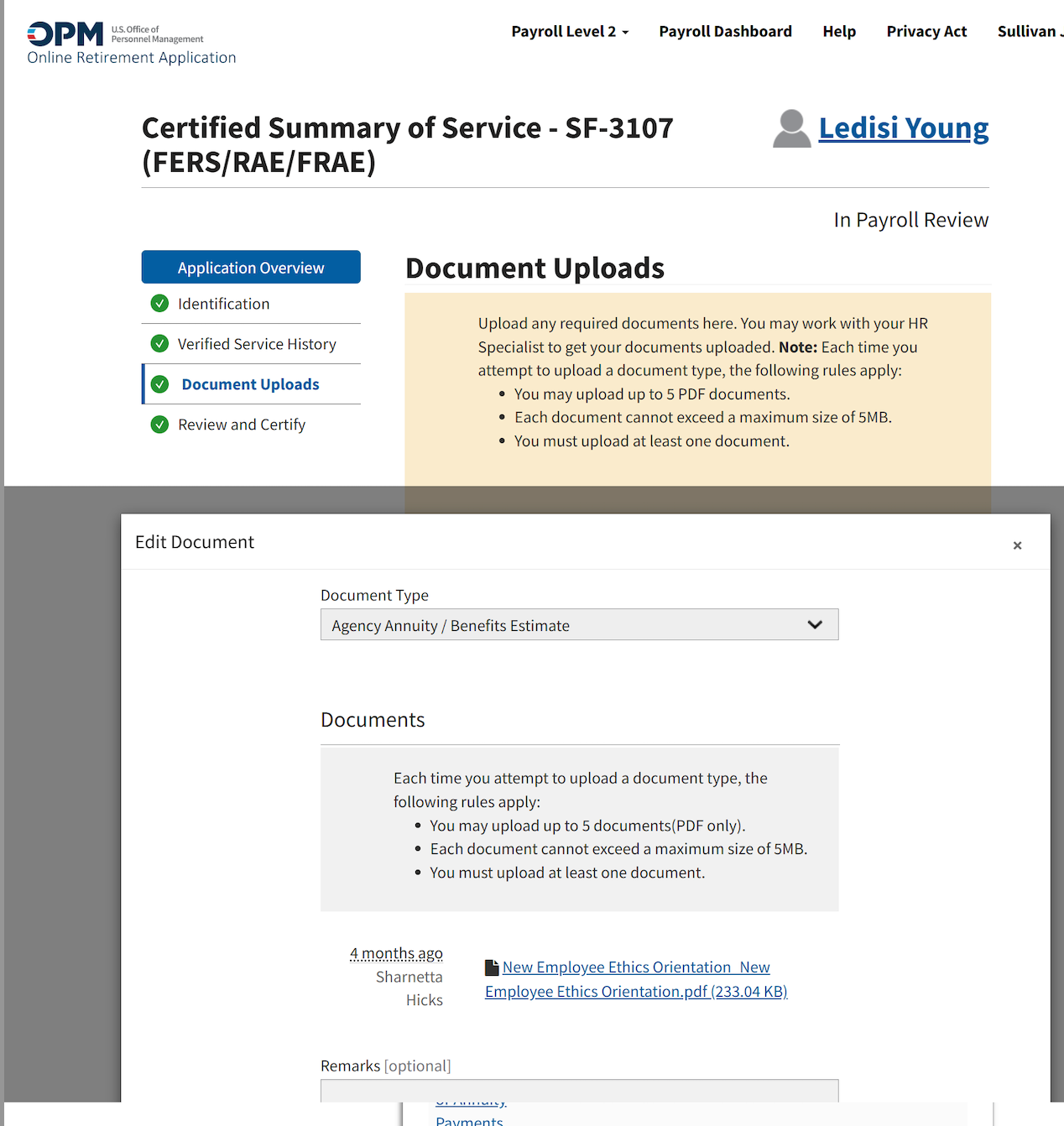

OPM’s last attempt at modernization had kicked off the Online Retirement Application (ORA), which set out to serve as a digital version of paper-based retirement applications. However, despite starting in 2018 and millions of dollars per year in investment, the platform was still not fully functional. It looked and performed like a website from the 1990s, and key features that were needed for real usage were still missing.

We initially tried to embed ourselves alongside the OPM development team to accelerate its completion. There were certain retirement types that were critical but not yet supported, and there was no ability for applicants to upload supporting documentation PDFs larger than 5MB.

What should have been simple ended up near impossible: once again, OPM had bet this modernization effort on a flawed technical direction from the outset. They had committed to building all of this on Microsoft PowerApps, a “no-code” tool meant for building simple web apps, not a professional development platform. For all the complexities required to truly move retirements off of paper, this would be like giving a construction crew Lego bricks to build a 100-story skyscraper.

When we met with the developers in Macon, Georgia, OPM's engineering hub, they told us the PowerApps experience was so unfriendly that even they were afraid to make changes. Unless they’ve been specifically trained with PowerApps, most software developers would find it extremely unintuitive to build with, making it hard to apply classic coding skills or iterate quickly.

After several more weeks with little progress and only a few weeks left until launch, we called an emergency meeting.

We could either continue wrestling with the PowerApps approach with no clear path to success, or pull a Hail Mary of rebuilding the whole system in a modern way. It would be a herculean effort, but it was the only option that gave us a real shot at delivering. The resulting payoff would be the speed, flexibility, and modern capabilities that we knew were possible.

Scrapping a seven year effort in favor of a weeks-long rebuild wasn't a decision we took lightly. With a high-profile, government-wide rollout already announced, intense public scrutiny, and OPM's painful history of failed attempts, the idea must have sounded insane to many. Yet, it was somehow the most reasonable path forward.

We were up until 3AM that night detailing next steps. We made a plan for what to do, who to talk to, and how to divide the work. By the next morning, we were off to the races.

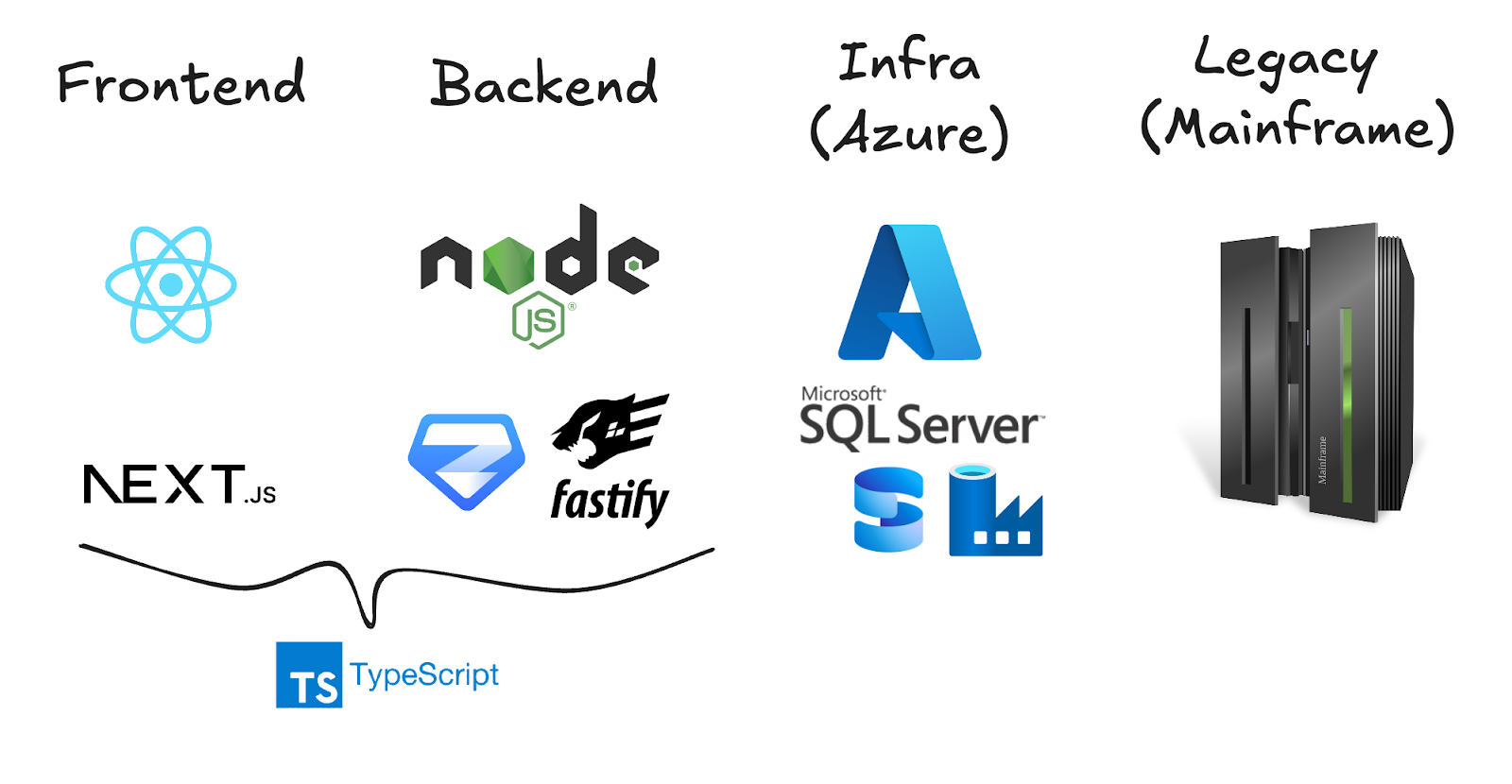

A New Technical Direction

The approach we set for OPM was to stand up a digital platform that could connect every source of retirement information, and serve a modern experience to every user in the process. We leveraged industry standard web technologies, while integrating with some of OPM’s existing expertise to prioritize easy adoption and longevity. Beyond just enabling our immediate team to move fast, we needed to set a foundation for years to come beyond our direct involvement. The technologies we chose were broadly adopted by the developer community, well documented, and battle-tested.

This would usually be the part of a technical blog where we would brag about fancy frameworks or proudly show off a unique architecture design. The reality is we simply stuck to solid fundamentals: understand your query patterns, make sure tables are properly indexed, write efficient joins, and execute things in batch - and when the time calls for it, move long-running processes off the main application and onto asynchronous workers (we used Azure Functions).

An additionally unique aspect of government was that it can be challenging to get third party vendor tooling. As a result, we often built much of our own tooling from scratch, including our own roles based permissioning system and a feature flagging system.

All of this was developed in the ensuing weeks towards launch. After a blur of late nights, last minute bug fixes, and constant communication with the OPM team, we finally got it done.

On June 2, 2025, retire.opm.gov went live. By August 4th, almost every agency in the federal government was using the new Online Retirement Application, ending all paper submissions.

Designing A Better Experience

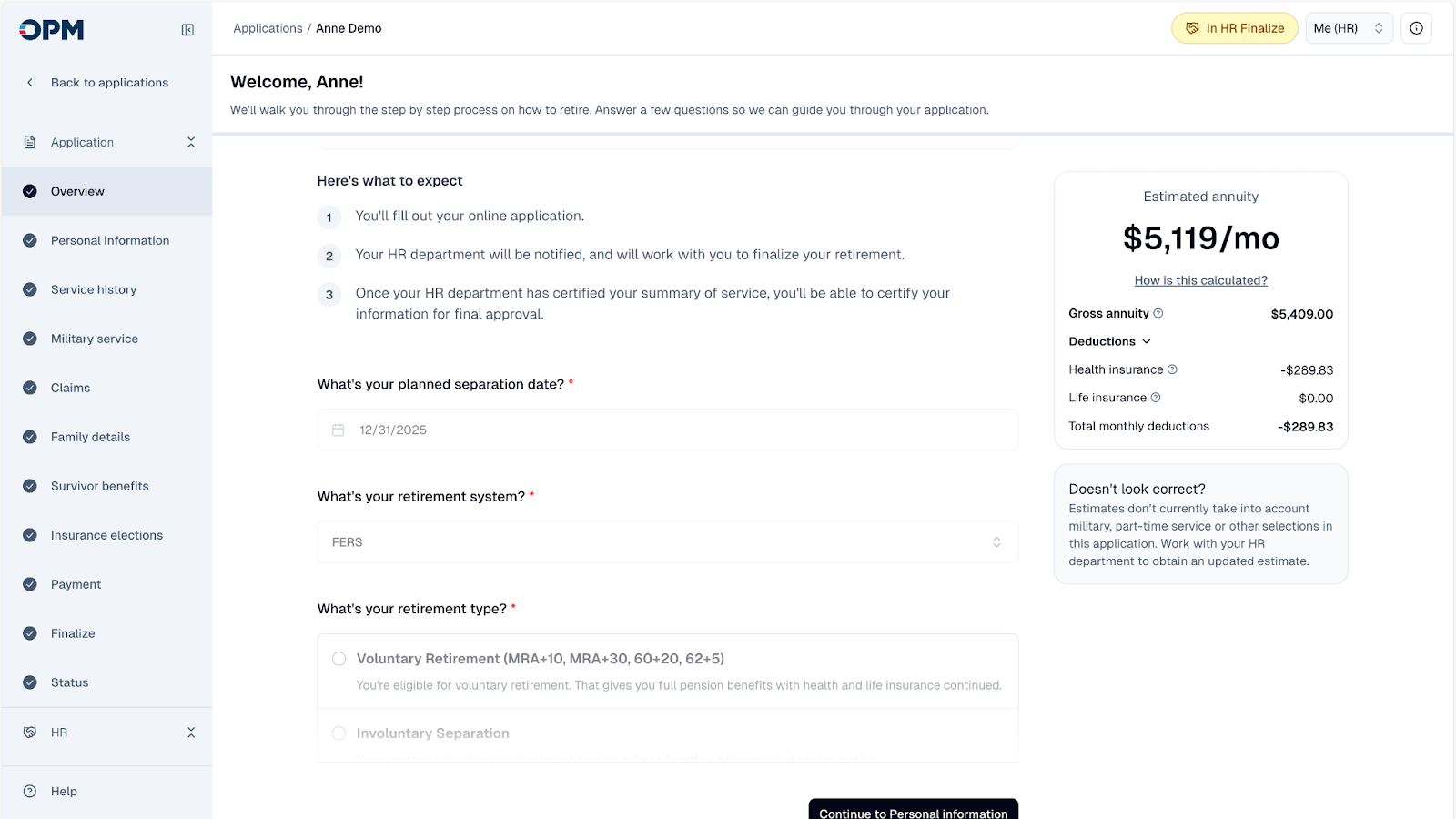

With the system online, there were still many improvements to be made. Like taxes, applying for retirement was still an incredibly confusing process. Working closely with talented designers and the Retirement Services team at OPM, we set out to reinvent the user experience from end-to-end.

During the day we’d collaborate closely with Retirement Services to synthesize feedback from users all across the government. At night, we’d lock in and address every last issue and complaint.

Impactful features came out of this: the new Online Retirement Application now incorporates a live annuity estimator so users can see how their choices for benefits and elections impact their annuity in real-time as they fill out their application, instead of finding out months later as they receive their first check.

The Promise Of “Instant” Retirement

Even though retirees and agencies now work on a modern digital foundation, the delays and redundant steps have not yet been fully eliminated. Retirees still wait longer than necessary for their full paycheck.

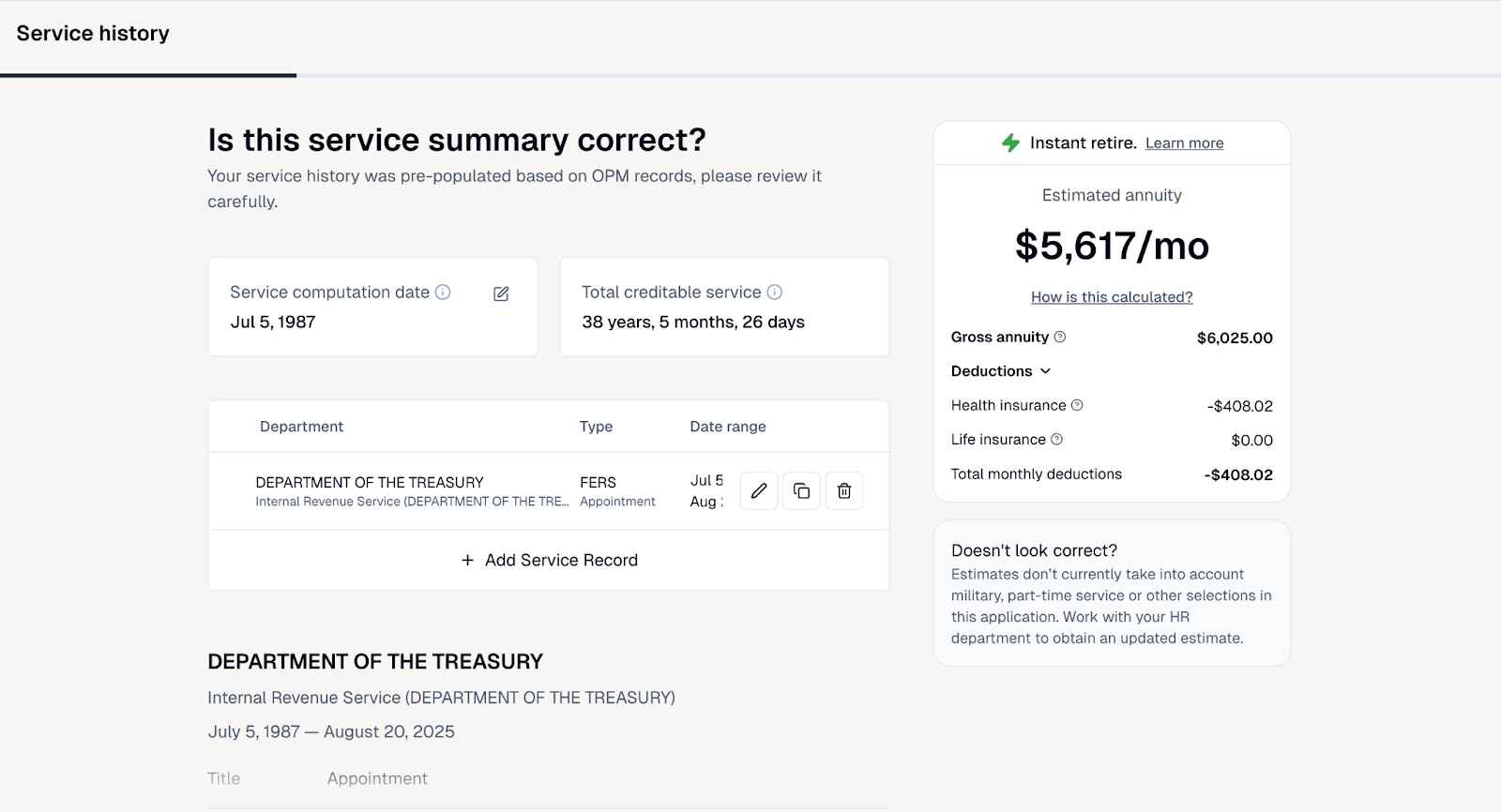

Fortunately, we stumbled on a critical clue. While poring over old documentation, we discovered that OPM actually had data warehouses that stored historic information about every federal employee. Apparently, these warehouses were created as part of a modernization effort in 2007, and HR and payroll offices all across government have supposedly been regularly reporting into it.

For some reason however, this was not well known at OPM, and those that knew about it didn’t know what data it held, nor considered how it could be used to simplify retirement processing. Not many had seen the data, and administrators were initially resistant to sharing access.

From a software perspective, this was the holy grail: a single source of truth that held all the information that the manual redundant steps were meant to review. Because the information was regularly reported by HR and payroll, by the time an employee retired, OPM should already have everything needed to process the retirement, without anyone re-entering or re-verifying information.

We needed to see this data for ourselves. After weeks of navigating through a jungle of bureaucratic red-tape, what we finally uncovered was eye-opening: the data was far richer and higher-quality than anyone had anticipated. All along, OPM had actually been sitting on top of a digital version of their underground Mine. It had just been forgotten and buried over time.

The hypothesis was clear: if we could successfully incorporate this high-quality data into the new digital workflow — and prove its reliability to every stakeholder along the way — we could eliminate the time-consuming manual checks entirely.

Operations gave us 500 recently processed applications to test with, and we queried the data out of the databases into the official annuity calculator. Result: Every non-complex case matched down to the penny. This proved that the buried digital mine was accurate enough to pay retirees their exact amount on day one.

Around the agency, people were excited, but still tentative: What about missing fields? What about the messy edge cases?

Our solution was through product design. The “Instant” experience would be a “show but verify” type of experience. Retirees see their application pre-filled from OPM's data, then get the opportunity to make corrections. If the data looks correct and they don't make elections that complicate the case, the application qualifies as "Instant".

We launched this offering in the new Online Retirement Application (ORA), where thousands of cases now qualify for “Instant” processing.

Last month, we returned to the Mine to pilot these with the team using real retirements. Deep underground, next to the old stacks of paper, the team triggered their first ever “instantly adjudicated” application. The experiment’s success proved what we had hoped: OPM’s existing data could reliably process Instant cases without manual work.

Now, with everyone bought into the vision, we are setting our sights towards making Instant retirement a widespread reality.

What’s Next

Over the next few months the technical work will only get more sophisticated as we aim to create the first truly automated retirement process end-to-end. Imagine “Full Self-Driving” with no manual interventions or redundant checks, delivering rapid retirements and paychecks for our retiring civil servants.

We’ll expand the “Instant” program government-wide by partnering with HR and payroll offices to simplify some of their processes as well. It’s not just the OPM portion that will experience faster processing and reduced backlogs, every participant in the process will see improvements.

Along the way, we’ll also keep building the tools our users need. From simple wins like bulk case management and real-time dashboards, to sophisticated AI that flags potential issues early, these tools will further help to reduce processing time, even for cases where manual work is still necessary.

Our initial data warehouse discovery unlocked the first Instant cases, but dozens of other systems — payroll, insurance, personnel records — hold valuable data. New integrations are coming which will result in more pre-filled fields, fewer errors, and faster, more accurate outcomes.

The pattern is consistent - the data to streamline federal services often already exists, it's just sitting in disconnected systems that don't talk to each other. Connect them, and suddenly month-long processes can become instant.

Outdated systems are everywhere in government, and initiatives like ours are exactly what the President’s Executive Order earlier this year called for. We hope this project serves as a blueprint for similar efforts, demonstrating how to successfully drive the technological and operational changes needed to bring government into the modern era.

Reflections

A year ago, government work wasn't even on our radar. But the reality surprised us.

Every federal employee who retires from now on can use what we built — for all 2.3 million current employees and everyone who follows. We shipped a government-wide system in six months, built to last. Few places let you create this kind of impact this fast.

The problems are genuinely interesting — integrating fragmented systems with no single source of truth, encoding decades of retirement law, bridging legacy tech, building trust in automation, and driving the operational shifts to match.

We built most of this as a small team of two engineers. We're still building, and there’s many more opportunities like this throughout the government. If this sounds like the kind of problem you want to work on, we should talk.

Thank you to Scott Kupor, Joe Gebbia, the OPM Retirement Services team, and countless others for their partnership in making this project a reality. Additional thanks to Edward Coristine and Zach Terrell for reviewing this blog post.